PROPERTY developer Glomac Bhd (KL:GLOMAC) is aware it has been in a “slumber” over the past few years but it is now “waking up” and ready to take on more opportunities, not just in property development but perhaps also in green energy, according to its group managing director and CEO Datuk Seri FD Iskandar Mohamed Mansor.

Armed with a war chest boosted by a RM3 billion perpetual sukuk, Iskandar says the group is aiming to sell around RM1 billion worth of properties in the next three financial years.

The group is also looking at opportunities to diversify into areas that have synergies with its core business in property development. While FD Iskandar is non-committal about what these new businesses may be, he hints that one of them could be green energy.

“One of the things I know some companies have looked at but nobody has done in a big way is waste-to-energy. You know where the waste is going. You can’t keep on filling up land after land, you know,” he says in a recent interview at his office in Menara Glomac.

The RM3 billion perpetual sukuk programme gives Glomac access to capital whenever there is a need for it, FD Iskandar says. The issuance of the first tranche, worth around RM250 million, was scheduled to be completed by end-September.

Between 30% and 35% of this issuance will be used to pare down debt in order to save on financing costs, he adds. The other 60% to 65% will be used to acquire land in strategic areas to boost the potential gross development value (GDV) of Glomac’s landbank, he elaborates. At present, the company has about 600 acres of land bank, located in the Klang Valley and Johor. Its current land bank has an estimated RM7 billion in potential GDV.

FD Iskandar wants Glomac to be more aggressive at launching properties and selling them. The group launched about RM450 million worth of properties in its financial year ended April 30, 2024 (FY2024).

“So, if we were to do about RM470 million each year, it would take me, what, 15 years (to launch the RM7 billion potential GDV)? So in places that we think there’s a market — you know it is very cyclical, you have your good five years, and then a slow five years — if we hit the right market at its right cycle, I think we should go.

“We shouldn’t wait for 15 years to finish the RM7 billion GDV. Maybe we should cut it to half, to eight or nine years,” he adds.

Having said that, FD Iskandar is reluctant to commit to a targeted GDV figure, saying only that Glomac must have more launches each year. He adds that the company has the capacity to launch RM700 million worth of properties annually. Hitting RM1 billion a year shouldn’t be difficult, he says.

Some may consider Glomac too ambitious, especially since it has not been able to sell as much as it launched in a year.

In FY2024, its revenue from property development was RM242.02 million. This means it sold only a little more than half of the value of the properties it launched during the period. This does not take into account whether the properties sold were from its previous or latest projects.

In fact, Glomac’s revenue from property development has been falling over the past few years. From RM380.18 million in FY2018, it slid to RM345.84 million in FY2021, and RM319.44 million in FY2023.

FD Iskandar will need to motivate his team to push for RM1 billion in launches, which may see its property sales revenue hitting around RM500 million — double its FY2024 revenue — if just half its new launches are sold.

However, a key concern is whether there is sufficient demand in the property market now to absorb the launches.

According to the latest report from the National Property Information Centre (Napic), property transactions in the central region in the first half of the year jumped 11.6% year on year to 47,763, with a value of RM46.09 billion.

“The central region property market performance improved in 1H2024, as indicated by the increase in market activities,” says Napic in the report. “In terms of transaction volume, all three states showed an upward trend.”

Property transactions increased the most in Putrajaya (up 45.7%), followed by Kuala Lumpur (22.7%) and Selangor (8.8%).

At the same time, there were 5,681 completed but unsold residential units in the central region valued at RM5.26 billion, 13,422 unsold units still under construction and 5,360 unsold units that had yet to be built.

Some states saw an improvement over 2H2023, says Napic. Kuala Lumpur and Selangor had an overhang of 3,051 and 2,328 units respectively, 13.7% and 31.6% lower than in 2H2023. Putrajaya, on the other hand, saw an increase in overhang units to 302 from 137.

But the overall situation for unsold units under construction worsened in the central region in 1H2024, as the figure climbed 6.4% over 2H2023. The same was true for unsold and yet-to-be-constructed units, which increased by 11.6% during the period.

Out of Glomac’s 600 acres of land, about 400 acres are located in the Klang Valley. The biggest plot in the Klang Valley, about 100 acres, is in Puchong, while the rest are spread over Rawang, Sungai Buloh and Subang.

In Johor, Glomac has about 165 acres of land in Kulai as well as in Ulu Tiram.

“We bought this land (in Ulu Tiram) a long time ago, in 1996 [about 500 acres then]. We have [yet to develop] the last 10% of the 500 acres, which works out to maybe another 50 to 60 acres,” says FD Iskandar.

He is optimistic about the prospects of the Johor property market, given the increase in foreign direct investments into the state in recent years, particularly in the data centre space.

“This will hopefully provide good-paying jobs, high-paying jobs. And the people will need houses, shops, commercial areas and whatnot, right? Not everybody can do data centres, so we’ll provide the housing and the commercial centres.”

He adds that the biggest market for property in Johor is still Malaysians working in Singapore, rather than from the new jobs that will be created by the influx of data centre investments.

The land in Kulai is strategically located as it is near the Second Link and Johor-Singapore Causeway, which is still the main route for Johoreans to get to Singapore every day for work, says FD Iskandar.

“Now, we are about to launch another 120 residential units. But once we do this, we are looking at the commercial side. Because we are only, like, 5km away from the Second Link and we are nearer to the [Johor Bahru] city centre.”

Low gearing

In the first quarter ended July 31, 2024 (1QFY2025), Glomac reported a 75% jump in net profit to RM7.28 million from RM4.06 million in the previous corresponding quarter, as revenue rose 21.9% to RM73.29 million from RM60.11 million.

The stronger performance was driven not just by higher revenue but also improved profit margins, due to greater contribution from projects with better margins during the quarter under review, says Glomac in a press statement accompanying the results.

Contributing projects included Saujana Perdana in Ijok, Kuala Selangor, and two high-rise residential projects, Plaza@Kelana Jaya and 121 Residences@Damansara in Petaling Jaya, the group says.

As at July 31, 2024, the group had a negligible net gearing of 0.06 times against shareholders’ funds of RM1.25 billion, while cash and deposits stood at RM292.4 million against short-term borrowings of RM237 million.

Glomac plans to launch RM459 million worth of properties in the current financial year ending April 30, 2025. They include double-storey houses at its established township developments of Serai@SBCR in Sungai Buloh, Saujana KLIA and Saujana Jaya in Kulai.

It will also be introducing the second phase of its KEYS@Lakeside Residences in Puchong, a semi-detached housing project within Puchong City Centre, with an expected GDV of RM192 million, in 2HFY2025.

FD Iskandar says Glomac’s RM3 billion perpetual sukuk will allow the group to refinance some of its loans, which bear high interest rates. He sees the group saving around 0.8% to 0.9% in interest on these loans.

As at July 31, 2024, Glomac’s total borrowings stood at RM360.39 million, of which RM236.89 million are due by July 31, 2025. Based on the latest year-end’s cut-off date of April 30, 2025, it would have borrowings of RM122.81 million due by April 30, 2026.

This means Glomac will still have a substantial amount of funds in its war chest with the perpetual sukuk even after it pays off its borrowings.

“We want to be in a position where we have the capacity to undertake an opportunity when we find it,” says FD Iskandar.

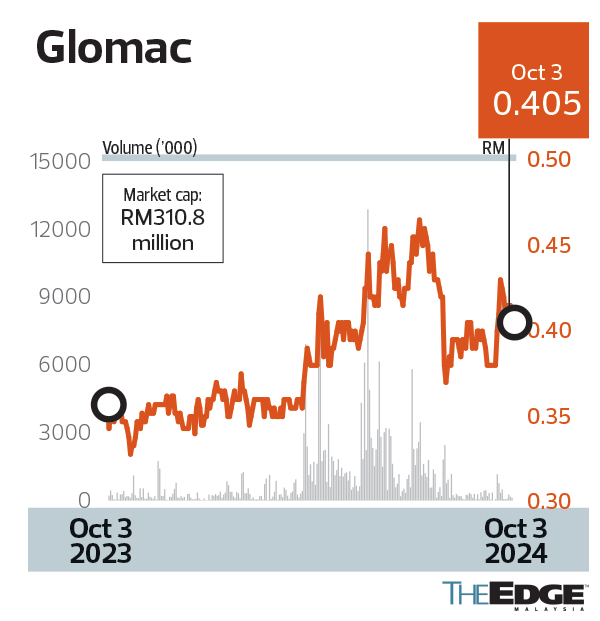

Glomac’s share price closed at RM42 sen last Tuesday, valuing the group at RM289.37 million. Year to date, the counter has appreciated by 15.28%.

Source: The Edge Malaysia